The Ultimate Guide To Affordable Bankruptcy Lawyer Tulsa

The Ultimate Guide To Affordable Bankruptcy Lawyer Tulsa

Blog Article

Facts About Bankruptcy Lawyer Tulsa Revealed

Table of ContentsHow Affordable Bankruptcy Lawyer Tulsa can Save You Time, Stress, and Money.The Greatest Guide To Chapter 13 Bankruptcy Lawyer TulsaWhat Does Tulsa Bankruptcy Attorney Do?Tulsa Bankruptcy Attorney Can Be Fun For EveryoneBankruptcy Law Firm Tulsa Ok Fundamentals Explained

The statistics for the other primary kind, Phase 13, are also worse for pro se filers. (We break down the distinctions in between both kinds in deepness below.) Suffice it to claim, talk with a legal representative or 2 near you that's experienced with insolvency legislation. Here are a few sources to discover them: It's reasonable that you may be reluctant to pay for a lawyer when you're already under significant monetary stress.Several lawyers also provide free appointments or email Q&A s. Take advantage of that. Ask them if insolvency is undoubtedly the appropriate option for your circumstance and whether they think you'll certify.

Advertisements by Money. We might be compensated if you click this advertisement. Advertisement Currently that you have actually decided insolvency is certainly the right training course of action and you with any luck cleared it with a lawyer you'll require to obtain begun on the documents. Before you dive right into all the official personal bankruptcy kinds, you need to get your own files in order.

More About Bankruptcy Attorney Tulsa

Later on down the line, you'll actually require to show that by disclosing all kind of information concerning your economic affairs. Here's a basic checklist of what you'll require when traveling in advance: Identifying papers like your chauffeur's certificate and Social Safety card Income tax return (as much as the past 4 years) Proof of income (pay stubs, W-2s, freelance incomes, revenue from properties along with any type of revenue from federal government benefits) Financial institution declarations and/or retirement account statements Evidence of worth of your possessions, such as lorry and genuine estate appraisal.

You'll desire to recognize what type of financial debt you're trying to settle.

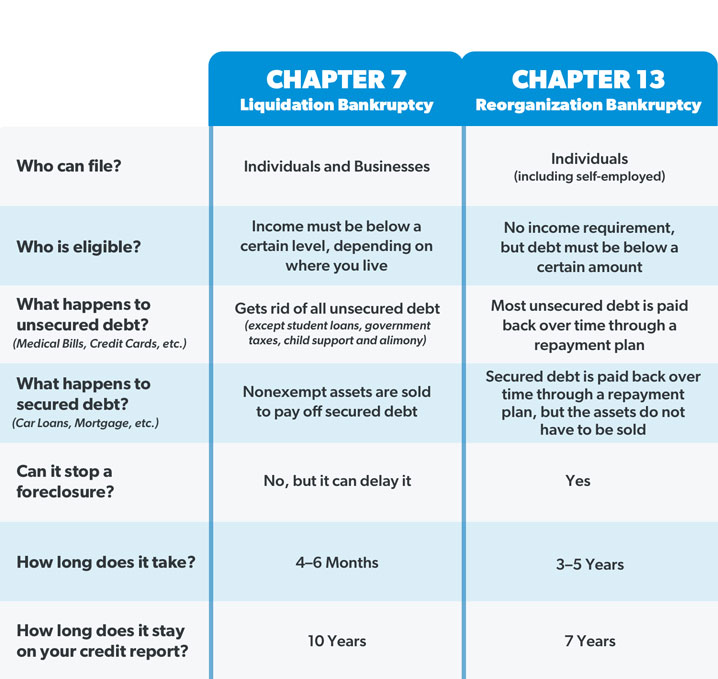

You'll desire to recognize what type of financial debt you're trying to settle.If your revenue is too expensive, you have one more option: Phase 13. This option takes longer to fix your financial obligations because it calls for a lasting repayment plan usually 3 to 5 years prior to a few of your staying debts are wiped away. The declaring procedure is additionally a lot much more complicated than Phase 7.

The Ultimate Guide To Tulsa Bankruptcy Consultation

A Phase 7 bankruptcy remains on your credit score report for ten years, whereas a Chapter 13 insolvency drops off after 7. Both have long lasting influence on your credit report, and any kind of new financial obligation you get will likely include higher rate of interest. Prior to you send your personal bankruptcy types, you have to initially finish a mandatory program from a credit rating therapy agency that has actually been approved by the Division of Justice (with the notable exception of filers in Alabama or North Carolina).

The course can be finished online, face to face or over the phone. Programs commonly set you back in between $15 and $50. You must finish the course within 180 days of declare bankruptcy (Tulsa OK bankruptcy attorney). Use the Department of Justice's site to locate a program. If you stay in Alabama or North Carolina, you must pick and complete a program from a listing of separately approved suppliers in your state.

Fascination About Tulsa Bankruptcy Attorney

A lawyer will generally handle this for you. If you're submitting by yourself, understand that there have to do with 90 various insolvency districts. Inspect that you're filing with the proper one based upon where you live. If your long-term home has actually moved within 180 days of loading, you should submit in the area where you lived the better section of that 180-day period.

Typically, your personal bankruptcy attorney will deal with the trustee, however you may need to send out the person papers such as pay stubs, income tax return, and savings account and charge card statements directly. The trustee who was just appointed to your situation will quickly establish up a necessary meeting with you, referred to as the "341 meeting" because it's a bankruptcy attorney Tulsa need of Section 341 of the united state

You will need to supply a prompt listing of what certifies as an exemption. Exceptions may put on non-luxury, main vehicles; needed home items; and home equity (though these exceptions regulations can vary commonly by state). Any residential or commercial property outside the list of exemptions is thought about nonexempt, and if you don't give any kind of list, after that all your residential property is considered nonexempt, i.e.

You will need to supply a prompt listing of what certifies as an exemption. Exceptions may put on non-luxury, main vehicles; needed home items; and home equity (though these exceptions regulations can vary commonly by state). Any residential or commercial property outside the list of exemptions is thought about nonexempt, and if you don't give any kind of list, after that all your residential property is considered nonexempt, i.e.The trustee wouldn't market your cars to instantly pay off the lender. Instead, you would certainly pay your creditors that amount throughout your payment strategy. A typical mistaken belief with insolvency is that as soon as you file, you can stop paying your financial obligations. While insolvency can help you clean out a lot of your unprotected financial debts, such as overdue clinical bills or individual loans, you'll intend to keep paying your month-to-month repayments for secured financial obligations if you intend to keep the residential or commercial property.

Unknown Facts About Affordable Bankruptcy Lawyer Tulsa

If you're at danger of repossession and have exhausted pop over to this website all other financial-relief alternatives, then submitting for Phase 13 may postpone the repossession and conserve your home. Inevitably, you will still require the income to proceed making future home loan payments, along with settling any type of late settlements throughout your layaway plan.

The audit could postpone any financial obligation relief by a number of weeks. That you made it this far in the process is a good indicator at least some of your debts are eligible for discharge.

Report this page